Price Guide: Debt Recovery

We are required by the Solicitors Regulation Authority to publish the below pricing information. Please note, the below is applicable only to the stated circumstances. Please contact us for an accurate fee proposal based on your particular facts and circumstances. Where VAT is charged, this will be at 20%. This type of work will be supervised by the Head of the Dispute Resolution Department.

Undisputed Debt Recovery

There are occasions when, for seemingly no reason that you are aware, a party fails to pay to you what is due and owing. There is no disagreement about the service or goods provided, or the amount charged, but payment has not been received.

We describe this as “debt recovery” and differentiate it from what we would otherwise call a contract dispute which is where one party disagrees that the sum is owing for any given reason.

We are able to offer an affordable and cost-effective means of seeking to recover your debt.

Our fee includes:

Taking your instructions and reviewing documentation

Undertaking appropriate searches

Sending a Letter before Action

Drafting and Issuing a Court Claim

Where no Acknowledgment of Service of Defence is received, applying to the Court to enter Judgement in Default

When Judgement in Default is received, writing to the other side to request payment

If payment is not received within 14 days, providing you with advice on next steps and likely costs

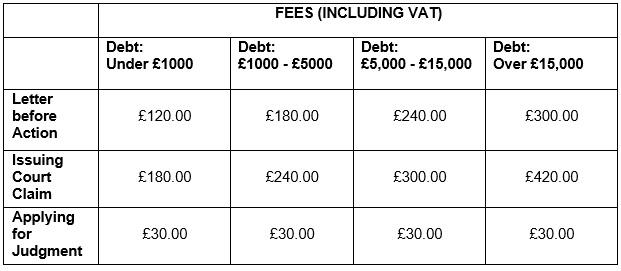

Our fees for this work are broken down at each stage and are determined by the value of the debt being sought. The fees are as follows, inclusive of VAT at 20%

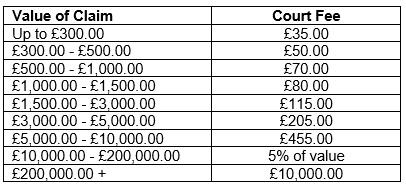

In addition to this firm’s costs, there is a Court fee payable on issuing a claim at Court. This is set as follows:

Note that VAT is not applied to Court Fees.

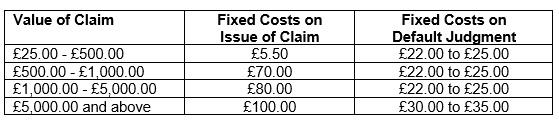

When issuing a claim, you are able to recover, subject to the Court allowing it, the Court Issue fee and a contribution towards our fees. The contribution the Court will allow is as follows:

We will, as a matter of course, consider when preparing the Letter before Action and issuing proceedings whether statutory or contractual interest can be added to the debt, costs as set out above and/or any compensation as may be allowed by, in particular, the contract or the Late Payment of Commercial Debts (Interest) Act 1998.

The above costs apply, as outlined, when the matter is in relation to an unpaid invoice which is not disputed, and enforcement action is not needed. They include 30 minutes of routine communication, and additional correspondence may be charged in addition; we will discuss this with you if the position arises. It presupposes that payment will be made by the other party following receipt of the Letter before Action, following receipt of Court proceedings or following granting of Default Judgment by the Court. In the event that enforcement action is required, such as for the instruction of a bailiff, advice of the options available will be presented to you. In addition, if the other party disputes your claim at any point, we will then discuss any further work required and provide you with advice about costs as necessary. Any additional work that does not fall into the original scope of work will be charged accordingly.

Matters usually take anywhere between 1 and 8 weeks from receipt of instructions from you to receipt of payment from the other side, depending on whether or not it is necessary to issue a claim. This is on the basis that the other side pays promptly on receipt of Judgment in Default. If enforcement action is needed or the debt is disputed, the matter will take longer to resolve.

Please note that the fees apply to undefended debt recovery which may require Court involvement or enforcement. If the matter becomes defended, then we will advise you on the next steps.

Disputed Debt Recovery

It is important to remember that Defended debt recoveries start in the same manner as undefended debt recoveries.

If, once a Letter Before Action has been issued in respect of an undisputed invoice, the Claim is defended and you wish us to continue to act for you, the case will be passed to member of our Dispute Resolution team who will provide you with charging rates and a range of estimated fees at that point.

Fees and timings for defended debts, insolvency, statutory demands and winding up are all dependent on the facts and circumstances of the case.

Timescales for defended debt recovery work will be dependant on the facts – we are therefore unable to provide a typical timescale as timescales will depend on many factors including the complexity of the case and current Court timetables. Defended debt claims could potentially take a significant period of time.

Please contact us for a fee proposal tailored to your particular facts and circumstances.

The hourly rates of our team are as follows:

| AJ King | Director / Solicitor | £375 |

| M Cox | Senior Associate Solicitor | £325 |

| P Gangah | Associate Litigator | £300 |

| T Barbeary | Solicitor | £275 |

| Trainee solicitors | £150 | |

| Paralegals | £135 | |

| Consultants / locums | £250 |

All hourly rates are subject to VAT at 20%.

For further information about our team members, please click here.

How We Can Help...

-

Contract Disputes (for businesses)

-

Professional Negligence

-

Contentious Probate and Inheritance Act Claims (for businesses)

-

Landlords and Tenants (for businesses)

-

Letting Agents (for businesses)

-

Building and Property Disputes

-

Debt Recovery (for businesses)

-

Director and Shareholder Disputes

-

Intellectual Property Disputes

Related Articles linked to Dispute Resolution…

To claim compensation for your loss... read more

Tags: Dispute Resolution Business/Dispute Resolution Personal/professional negligence/litigation/professional adviser/loss and damages

To show that your adviser has... read more

Tags: Dispute Resolution Business/Dispute Resolution Personal/professional negligence/litigation/professional adviser/loss and damages