Settlement Agreements: Your FAQ’s Answered

by Tamara Barbeary & Sunny Rafaeli

A Settlement Agreement (formally called a Compromise Agreement) is a legally binding document by which an employee agrees not to pursue certain legal claims against their employer in relation to their employment or its termination. In return, the employer will normally agree to pay the employee a sum of money as compensation, although there may be other additional benefits.

Settlement Agreements are commonly used to record an employee’s terms of departure, although they can also be entered into to settle an existing dispute, when employment is continuing.

It is important for employers to understand and seek advice on the legal requirements that a Settlement Agreement must comply with. The Agreement will be invalid if it fails to comply with these requirements, meaning the employee will still be able to bring a claim against the employer in the Employment Tribunal or civil courts.

An employee does not have to accept the Settlement Agreement offer. However, if they do, they must receive independent legal advice on the terms and effect of the Settlement Agreement. It is important for employees to be properly advised on the warranties and undertakings that they are giving in the Agreement to avoid situations that could give rise to an employer not paying the employee or requesting a refund of payments already made.

It is important to note that most legal claims regarding statutory and contractual rights can be waived as part of the agreed terms in a Settlement Agreement. However, not all claims can be settled this way. If you require specific assistance in relation to this, please contact our specialist team here at Lennons.

Q1 – Why do employers offer Settlement Agreements to employees?

A Settlement Agreement will often be offered to an employee who is being made redundant in exchange for an enhanced payment over and above the minimum statutory and contractual requirements. This may avoid the need for a potentially lengthy and stressful redundancy process, although it may also be offered after the redundancy consultation exercise has been carried out as protection for the employer.

A Settlement Agreement will often be offered to an employee who is being made redundant in exchange for an enhanced payment over and above the minimum statutory and contractual requirements. This may avoid the need for a potentially lengthy and stressful redundancy process, although it may also be offered after the redundancy consultation exercise has been carried out as protection for the employer.

Settlement Agreements may also be used to avoid a drawn-out performance or disciplinary process, which can often be costly and time-consuming for an employer and extremely stressful for employees and may lead to ongoing contention with the employee.

Also, Settlement Agreements are often proposed as a genuine attempt to settle an existing dispute. The alternative would usually involve a long drawn-out, costly and stressful process that neither party would want to follow through with.

However, these Agreements will also be used at the time of dismissal by some employers as a “belt and braces” approach, even where there is no question of a dispute. This does not necessarily mean that the employer considers that they are at risk of a claim. It is simply a way for an employer to protect itself, by ensuring that the employee will not raise any issues after the employee has left the business.

Q2 – What are the legal requirements of Settlement Agreements?

For a Settlement Agreement to be valid, the following statutory conditions must be met:

In other words, thought must be given, and be documented as having been given, to the possible claims that the employee will waive by signing the Settlement Agreement.

- The employee must have received independent legal advice from an independent adviser (most commonly, this will be a solicitor) on the Settlement Agreement and on its effect on the employee’s ability to pursue the rights in question.

- The independent legal adviser must have a current contract of insurance, or professional indemnity insurance, covering the risk of a claim against them by the employee in respect of the advice.

- The Agreement must identify the adviser.

- The Agreement must state that the conditions regulating Settlement Agreements under the relevant statutory provisions have been satisfied.

The Settlement Agreement will be invalid if it fails to comply with any of these requirements. Therefore, it is important for employers to obtain legal advice in relation to the drafting of these Agreements.

Q3 – What constitutes a ‘good deal’ for the employee?

This will depend entirely on the circumstances concerning the termination of employment or dispute to be settled during employment. Many factors may be relevant beyond the strength of any potential claims. For example, the risk to the employer; the likelihood and time frame of the employee securing alternative employment; the health of the employee and the impact of potential litigation on the employee’s health; the seniority of the employee; the contractual terms of employment; and the financial position of both parties.

The amount of the compensation payment is likely to be an important focus of the settlement discussions. The employee will usually seek to improve this, or to enhance the overall value of the package in other ways. This may be done for example by:

To comply with the statutory requirements for a valid Settlement Agreement, an independent legal adviser is not required to advise the employee on the merits of any potential legal claims against the employer, whether the deal on offer is a good one or whether they think the employee should accept it.

However, if required, we can advise employees on the offer, negotiating a higher settlement or bringing a potential claim against their employer and have extensive experience in doing so. This advice would be provided in a separate initial appointment and we could provide a fixed fee for that. This will be charged directly to the employee unless the employer agrees to increase its contribution to cover the additional advice. Generally, most employers will only contribute to the advice required under the legislation, but it will depend on the particular circumstances.

Q4 – Can the payments in a Settlement Agreement be made tax free?

In practice, the majority of payments made to an employee on the termination of employment are likely to be taxable apart from a termination award of up to £30,000, which may or may not include a statutory redundancy payment, payments made directly for the provision of outplacement support or re-training, and legal fees. Any termination award exceeding the £30,000 will be subject to tax and employer NICs (not employee NICs).

In practice, the majority of payments made to an employee on the termination of employment are likely to be taxable apart from a termination award of up to £30,000, which may or may not include a statutory redundancy payment, payments made directly for the provision of outplacement support or re-training, and legal fees. Any termination award exceeding the £30,000 will be subject to tax and employer NICs (not employee NICs).

The rules regarding the tax status of payments is complex, but generally deductions will be made for any payment that represents salary, including holiday pay, notice pay (whether notice is worked or a PILON is made), bonus and commission.

Employees may be entitled to exercise share options and receive share awards either before or at some point after termination. The tax and NICs liabilities will depend on many factors including whether the scheme is tax-advantaged, the length of ownership and the reason for cessation of employment. A cash cancellation or compensation payment will be fully taxable.

Employer contributions to registered pension schemes may be made tax free (and without using any of the £30,000 exempt amount). However, if contributions (employer and employee) exceed the annual allowance or the lifetime allowance, a tax charge arises to claw back excess tax relief.

Q5 – Does the Settlement Agreement have to state the reason for termination?

It will not always be necessary or advisable to refer to the reason for termination in the Settlement Agreement. However, the employee may want to make sure that a reason is “agreed” so that they are free from the possible stigma associated with poor performance, misconduct or a breakdown in the relationship. It is not uncommon to state that the reason for termination is redundancy or “termination by mutual agreement”. Any stated reason for termination should be reflected in any internal and external communications, as well as in any reference.

When considering what, if any, statement is made about the reason for termination, there may be other factors to consider, such as:

Q6 – What does the Settlement Agreement advice consist of?

The legal adviser will review the Settlement Agreement to ensure that it properly reflects what the parties have agreed and to make any necessary minor amendments for agreement with the employer.

The legal adviser will act as a relevant independent adviser as defined by law on the employee’s behalf in advising them:

- on the terms and effect of the Settlement Agreement.

- on their ability to pursue the claims specified in the Settlement Agreement.

- on the impact of breaching any of the terms in the Settlement Agreement.

Q7 – Who pays for the legal advice that an employee is required to take?

There is no legal requirement for an employer to pay for an employee’s legal fees in respect of independent legal advice. However, employers almost always offer to contribute toward the cost of their employees taking legal advice on the terms and effect of a Settlement Agreement.

There is no legal requirement for an employer to pay for an employee’s legal fees in respect of independent legal advice. However, employers almost always offer to contribute toward the cost of their employees taking legal advice on the terms and effect of a Settlement Agreement.

It is in the employer’s interests to pay all or most of the fee. Most employees will refuse to pay for legal advice themselves and given that failure to seek advice will deem the Agreement invalid, the expense for an employer is small in comparison to the cost of an ineffective waiver of the employee’s rights.

The employee can always ask the employer for an increase in the contribution if the amount originally offered is not enough to cover all the legal costs. However, this is also something than an independent legal adviser can do on behalf of the employee once they have been instructed to act, to take some of the stress off the employee.

It is important to note that the employer cannot recover the VAT on the employee’s legal costs as input tax, as the taxable supply has been made to the employee, not the employer. The solicitor’s invoice should be addressed to the client with a note that it is payable by the employer; addressing it to the employer to enable VAT recovery is arguably tax fraud. This is often misunderstood by employers.

Q8 – How much time should be given to an employee to consider the proposed Settlement Agreement?

An employer should not act inappropriately by putting pressure on the employee to accept a Settlement Agreement. Undue pressure may be an employer giving the employee an ultimatum to accept an offer or be dismissed when a disciplinary process has not been carried out, or to make an offer out of the blue and give a short timeframe for the employee to decide.

An employer should not act inappropriately by putting pressure on the employee to accept a Settlement Agreement. Undue pressure may be an employer giving the employee an ultimatum to accept an offer or be dismissed when a disciplinary process has not been carried out, or to make an offer out of the blue and give a short timeframe for the employee to decide.

The Acas Code on Settlement Agreements states that parties should be given a reasonable period of time to consider the proposed Settlement Agreement and that as a general rule, ten calendar days should be allowed to consider the proposed terms of a Settlement Agreement and to receive independent advice, unless the parties agree otherwise.

However, the Acas Code is not intended to set down concrete rules and the question of whether the employer has behaved ‘improperly’ is one for the Employment Tribunal to decide on all the facts. What is reasonable will depend on the circumstances in each individual case.

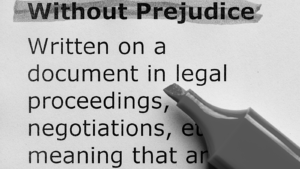

Q9 – What does “without prejudice and subject to contract” mean?

Correspondence about the Settlement Agreement and drafts of the Settlement Agreement itself will usually be marked with “without prejudice and subject to contract”.

Correspondence about the Settlement Agreement and drafts of the Settlement Agreement itself will usually be marked with “without prejudice and subject to contract”.

The phrase “without prejudice” is a common law rule intended to mean that any communications (written or verbal) that are made in a genuine attempt to settle a dispute cannot be admitted in subsequent tribunal or court proceedings as evidence unless there has been improper behaviour. The without prejudice rule does not apply where the parties are not yet in dispute. However, under the Employment Rights Act 1996, pre-termination negotiations may be protected from admissibility in unfair dismissal proceedings even where the parties are not in a dispute at the time of the negotiations.

The reason for labelling the communications “without prejudice” is to enable the parties to discuss termination arrangements freely and attempt to reach an amicable resolution without fear of such discussions or correspondence being used against them in a court or tribunal if agreement can’t be reached.

“Subject to contract” means that the Settlement Agreement cannot be relied upon by either employer or employee until it has been properly executed by the parties and becomes legally binding.

Q10 – Can the employee get a reference with the Settlement Agreement?

There is no legal obligation for an employer to provide a reference unless it is a contractual right or it is specifically referred to in a Settlement Agreement.

Therefore, an employee will want to ensure that there is a clause in the Settlement Agreement obliging the employer to provide a reference, in the form attached to the Settlement Agreement, on request from a prospective employer.

Any reference that is provided must be truthful and accurate. Most employers will only provide a factual reference (setting out the dates of the employment and the employee’s job title) to avoid claims, ensure equality of treatment, and ensure managers cannot say anything that may cause issues for the employer.

Q11 – Are Settlement Agreements confidential?

It is normally in both parties’ interests for the terms of the Settlement Agreement to remain confidential and an express term to that effect is often included in the Settlement Agreement. This usually covers not only keeping the contents of the Settlement Agreement confidential, but the mere fact of its existence and the circumstances leading to it. Best practice is that such a clause should not be retrospective unless the employer had made it clear to the employee at the start of the negotiations.

Typically, the Settlement Agreement will only permit the employee to disclose its terms in limited situations, for example, to immediate family members and legal or professional advisers, or to make a protected disclosure. The independent legal adviser should check that the scope of the exceptions is wide enough in the circumstances.

It is common for the parties to also agree that they will refrain from making derogatory comments about one another after termination. In the employer’s case, this will often be framed as an agreement to use reasonable endeavours to ensure that officers and employees do not make derogatory comments about the employee as there are limits to its control over staff.

Q12 – Why should an employee or employer use the Employment Department at Lennons Solicitors to receive advice on Settlement Agreements?

- We are highly experienced in advising employees on Settlement Agreements and helping negotiate the terms of these Agreements, where required.

- We offer a quick service to turn Settlement Agreements around within tight deadlines which frequently arise with these Agreements.

- We also have experience in drafting Settlement Agreements to help employers meet the relevant statutory requirements.

- We offer fixed fees for this work so that employers and employees can effectively manage their budget.

If you require specific assistance in relation to any of the above issues or any other employment related matters, please contact our specialist team here at Lennons.